고정 헤더 영역

상세 컨텐츠

본문

시가총액 순으로 본 ETF

AUM(Asset Under Management) 순으로 살펴본 1위~100위 ETF 리스트입니다.

(2020년 8월 25일 기준)

세부 정보가 궁금하신 분은 아래 더보기를 누른 다음 해당 티커를 찾아 클릭하시기 바랍니다.

SPY SPDR S&P 500 ETF Trust Equity: U.S. - Large Cap State Street Global Advisors 0.09% $299.50B IVV iShares Core S&P 500 ETF Equity: U.S. - Large Cap Blackrock 0.03% $213.26B VTI Vanguard Total Stock Market ETF Equity: U.S. - Total Market Vanguard 0.03% $160.20B VOO Vanguard S&P 500 ETF Equity: U.S. - Large Cap Vanguard 0.03% $159.68B QQQ Invesco QQQ Trust Equity: U.S. - Large Cap Invesco 0.20% $131.35B AGG iShares Core U.S. Aggregate Bond ETF Fixed Income: U.S. - Broad Market, Broad-based Investment Grade Blackrock 0.04% $79.12B GLD SPDR Gold Trust Commodities: Precious Metals Gold State Street Global Advisors 0.40% $77.58B VEA Vanguard FTSE Developed Markets ETF Equity: Developed Markets Ex-U.S. - Total Market Vanguard 0.05% $75.37B IEFA iShares Core MSCI EAFE ETF Equity: Developed Markets Ex-U.S. - Total Market Blackrock 0.07% $70.73B VUG Vanguard Growth ETF Equity: U.S. - Large Cap Growth Vanguard 0.04% $61.06B VWO Vanguard FTSE Emerging Markets ETF Equity: Emerging Markets - Total Market Vanguard 0.10% $60.97B BND Vanguard Total Bond Market ETF Fixed Income: U.S. - Broad Market, Broad-based Investment Grade Vanguard 0.04% $59.98B IWF iShares Russell 1000 Growth ETF Equity: U.S. - Large Cap Growth Blackrock 0.19% $59.28B LQD iShares iBoxx USD Investment Grade Corporate Bond ETF Fixed Income: U.S. - Corporate, Broad-based Investment Grade Blackrock 0.14% $56.65B IEMG iShares Core MSCI Emerging Markets ETF Equity: Emerging Markets - Total Market Blackrock 0.13% $53.50B VTV Vanguard Value ETF Equity: U.S. - Large Cap Value Vanguard 0.04% $50.70B EFA iShares MSCI EAFE ETF Equity: Developed Markets Ex-U.S. - Total Market Blackrock 0.32% $48.14B VIG Vanguard Dividend Appreciation ETF Equity: U.S. - Total Market Vanguard 0.06% $46.38B IJH iShares Core S&P Mid-Cap ETF Equity: U.S. - Mid Cap Blackrock 0.05% $45.12B IJR iShares Core S&P Small-Cap ETF Equity: U.S. - Small Cap Blackrock 0.06% $43.83B IWM iShares Russell 2000 ETF Equity: U.S. - Small Cap Blackrock 0.19% $40.56B VCIT Vanguard Intermediate-Term Corporate Bond ETF Fixed Income: U.S. - Corporate, Broad-based Investment Grade Intermediate Vanguard 0.05% $38.33B VGT Vanguard Information Technology ETF Equity: U.S. Technology Vanguard 0.10% $36.40B IWD iShares Russell 1000 Value ETF Equity: U.S. - Large Cap Value Blackrock 0.19% $35.91B XLK Technology Select Sector SPDR Fund Equity: U.S. Technology State Street Global Advisors 0.13% $35.33B VO Vanguard Mid-Cap ETF Equity: U.S. - Mid Cap Vanguard 0.04% $34.47B USMV iShares MSCI USA Min Vol Factor ETF Equity: U.S. - Total Market Blackrock 0.15% $34.43B IAU iShares Gold Trust Commodities: Precious Metals Gold Blackrock 0.25% $31.22B VCSH Vanguard Short-Term Corporate Bond ETF Fixed Income: U.S. - Corporate, Broad-based Investment Grade Short-Term Vanguard 0.05% $31.15B IVW iShares S&P 500 Growth ETF Equity: U.S. - Large Cap Growth Blackrock 0.18% $30.68B BNDX Vanguard Total International Bond ETF Fixed Income: Global Ex-U.S. - Broad Market, Broad-based Investment Grade Vanguard 0.08% $30.39B HYG iShares iBoxx USD High Yield Corporate Bond ETF Fixed Income: U.S. - Corporate, Broad-based High Yield Blackrock 0.49% $30.27B VB Vanguard Small-Cap ETF Equity: U.S. - Small Cap Vanguard 0.05% $28.89B VNQ Vanguard Real Estate ETF Equity: U.S. Real Estate Vanguard 0.12% $28.83B ITOT iShares Core S&P Total U.S. Stock Market ETF Equity: U.S. - Total Market Blackrock 0.03% $27.42B VYM Vanguard High Dividend Yield ETF Equity: U.S. - High Dividend Yield Vanguard 0.06% $26.70B BSV Vanguard Short-Term Bond ETF Fixed Income: U.S. - Broad Market, Broad-based Investment Grade Short-Term Vanguard 0.05% $26.09B VEU Vanguard FTSE All-World ex-US ETF Equity: Global Ex-U.S. - Total Market Vanguard 0.08% $25.10B VXUS Vanguard Total International Stock ETF Equity: Global Ex-U.S. - Total Market Vanguard 0.08% $24.22B IWB iShares Russell 1000 ETF Equity: U.S. - Large Cap Blackrock 0.15% $24.04B XLV Health Care Select Sector SPDR Fund Equity: U.S. Health Care State Street Global Advisors 0.13% $24.02B EEM iShares MSCI Emerging Markets ETF Equity: Emerging Markets - Total Market Blackrock 0.68% $23.56B TIP iShares TIPS Bond ETF Fixed Income: U.S. - Government, Inflation-linked Investment Grade Blackrock 0.19% $23.19B DIA SPDR Dow Jones Industrial Average ETF Trust Equity: U.S. - Large Cap State Street Global Advisors 0.16% $23.04B SCHX Schwab U.S. Large-Cap ETF Equity: U.S. - Large Cap Charles Schwab 0.03% $22.49B MBB iShares MBS ETF Fixed Income: U.S. - Government, Mortgage-backed Investment Grade Blackrock 0.06% $22.11B SHY iShares 1-3 Year Treasury Bond ETF Fixed Income: U.S. - Government, Treasury Investment Grade Short-Term Blackrock 0.15% $21.46B IWR iShares Russell Mid-Cap ETF Equity: U.S. - Mid Cap Blackrock 0.19% $20.94B SHV iShares Short Treasury Bond ETF Fixed Income: U.S. - Government, Treasury Investment Grade Ultra-Short Term Blackrock 0.15% $20.84B IXUS iShares Core MSCI Total International Stock ETF Equity: Global Ex-U.S. - Total Market Blackrock 0.09% $20.77B IGSB iShares Short-Term Corporate Bond ETF Fixed Income: U.S. - Corporate, Broad-based Investment Grade Short-Term Blackrock 0.06% $19.63B IEF iShares 7-10 Year Treasury Bond ETF Fixed Income: U.S. - Government, Treasury Investment Grade Intermediate Blackrock 0.15% $19.62B SCHF Schwab International Equity ETF Equity: Developed Markets Ex-U.S. - Total Market Charles Schwab 0.06% $19.57B QUAL iShares MSCI USA Quality Factor ETF Equity: U.S. - Total Market Blackrock 0.15% $19.28B VV Vanguard Large-Cap ETF Equity: U.S. - Large Cap Vanguard 0.04% $19.18B TLT iShares 20+ Year Treasury Bond ETF Fixed Income: U.S. - Government, Treasury Investment Grade Long-Term Blackrock 0.15% $18.92B MUB iShares National Muni Bond ETF Fixed Income: U.S. - Government, Local Authority/Municipal Investment Grade Blackrock 0.07% $18.19B GDX VanEck Vectors Gold Miners ETF Equity: Global Gold Miners VanEck 0.52% $17.75B XLF Financial Select Sector SPDR Fund Equity: U.S. Financials State Street Global Advisors 0.13% $17.45B PFF iShares Preferred and Income Securities ETF Fixed Income: U.S. - Corporate, Preferred Blackrock 0.46% $16.58B EMB iShares JP Morgan USD Emerging Markets Bond ETF Fixed Income: Emerging Markets - Government, Non-Native Currency Blackrock 0.39% $16.14B SCHB Schwab U.S. Broad Market ETF Equity: U.S. - Total Market Charles Schwab 0.03% $15.96B IVE iShares S&P 500 Value ETF Equity: U.S. - Large Cap Value Blackrock 0.18% $15.92B XLY Consumer Discretionary Select Sector SPDR Fund Equity: U.S. Consumer Cyclicals State Street Global Advisors 0.13% $15.63B SDY SPDR S&P Dividend ETF Equity: U.S. - High Dividend Yield State Street Global Advisors 0.35% $15.60B SLV iShares Silver Trust Commodities: Precious Metals Silver Blackrock 0.50% $15.44B MDY SPDR S&P Midcap 400 ETF Trust Equity: U.S. - Mid Cap State Street Global Advisors 0.23% $15.08B GOVT iShares U.S. Treasury Bond ETF Fixed Income: U.S. - Government, Treasury Investment Grade Blackrock 0.15% $14.44B MINT PIMCO Enhanced Short Maturity Active ETF Fixed Income: U.S. - Broad Market, Broad-based Investment Grade Short-Term Allianz 0.36% $14.36B VT Vanguard Total World Stock ETF Equity: Global - Total Market Vanguard 0.08% $14.26B BIV Vanguard Intermediate-Term Bond ETF Fixed Income: U.S. - Broad Market, Broad-based Investment Grade Intermediate Vanguard 0.05% $14.12B BIL SPDR Bloomberg Barclays 1-3 Month T-Bill ETF Fixed Income: U.S. - Government, Treasury Investment Grade Ultra-Short Term State Street Global Advisors 0.14% $14.10B XLP Consumer Staples Select Sector SPDR Fund Equity: U.S. Consumer Non-cyclicals State Street Global Advisors 0.13% $13.99B JPST JPMorgan Ultra-Short Income ETF Fixed Income: U.S. - Broad Market, Broad-based Investment Grade Ultra-Short Term JPMorgan Chase 0.18% $13.66B VBR Vanguard Small-Cap Value ETF Equity: U.S. - Small Cap Value Vanguard 0.07% $13.39B IWP iShares Russell Mid-Cap Growth ETF Equity: U.S. - Mid Cap Growth Blackrock 0.24% $13.23B RSP Invesco S&P 500 Equal Weight ETF Equity: U.S. - Large Cap Invesco 0.20% $12.98B DVY iShares Select Dividend ETF Equity: U.S. - High Dividend Yield Blackrock 0.39% $12.84B JNK SPDR Bloomberg Barclays High Yield Bond ETF Fixed Income: U.S. - Corporate, Broad-based High Yield State Street Global Advisors 0.40% $12.80B SCHD Schwab U.S. Dividend Equity ETF Equity: U.S. - High Dividend Yield Charles Schwab 0.06% $12.46B ACWI iShares MSCI ACWI ETF Equity: Global - Total Market Blackrock 0.32% $12.43B VGK Vanguard FTSE Europe ETF Equity: Developed Europe - Total Market Vanguard 0.08% $12.42B SCHG Schwab U.S. Large-Cap Growth ETF Equity: U.S. - Large Cap Growth Charles Schwab 0.04% $12.18B XLU Utilities Select Sector SPDR Fund Equity: U.S. Utilities State Street Global Advisors 0.13% $11.83B SCHP Schwab U.S. TIPS ETF Fixed Income: U.S. - Government, Inflation-linked Investment Grade Charles Schwab 0.05% $11.74B DGRO iShares Core Dividend Growth ETF Equity: U.S. - Total Market Blackrock 0.08% $11.65B MTUM iShares MSCI USA Momentum Factor ETF Equity: U.S. - Total Market Blackrock 0.15% $11.61B VHT Vanguard Health Care ETF Equity: U.S. Health Care Vanguard 0.10% $11.57B VMBS Vanguard Mortgage-Backed Securities ETF Fixed Income: U.S. - Government, Mortgage-backed Investment Grade Vanguard 0.05% $11.55B IEI iShares 3-7 Year Treasury Bond ETF Fixed Income: U.S. - Government, Treasury Investment Grade Intermediate Blackrock 0.15% $11.28B VBK Vanguard Small-Cap Growth ETF Equity: U.S. - Small Cap Growth Vanguard 0.07% $11.15B IGIB iShares Intermediate-Term Corporate Bond ETF Fixed Income: U.S. - Corporate, Broad-based Investment Grade Intermediate Blackrock 0.06% $11.11B XLI Industrial Select Sector SPDR Fund Equity: U.S. Industrials State Street Global Advisors 0.13% $10.90B EFAV iShares MSCI EAFE Min Vol Factor ETF Equity: Developed Markets Ex-U.S. - Total Market Blackrock 0.20% $10.88B XLC Communication Services Select Sector SPDR Fund Equity: U.S. Telecommunications State Street Global Advisors 0.13% $10.41B XLE Energy Select Sector SPDR Fund Equity: U.S. Energy State Street Global Advisors 0.13% $10.13B FDN First Trust Dow Jones Internet Index Fund Equity: U.S. Internet First Trust 0.52% $10.04B SCHA Schwab U.S. Small-Cap ETF Equity: U.S. - Small Cap Charles Schwab 0.04% $10.03B IWS iShares Russell Mid-Cap Value ETF Equity: U.S. - Mid Cap Value Blackrock 0.24% $10.03B VXF Vanguard Extended Market ETF Equity: U.S. - Extended Market Vanguard 0.06% $9.85B

가장 큰 ETF는 SPY로 S&P 500 지수를 추종하며 3천억달러를 관리하고 있습니다. 약 360조원이네요. 총보수는 0.09%로 저렴한 편입니다. 2위 IVV와 3위 VOO는 보다 저렴한 수수료로 S&P 500 지수를 추종합니다.

ETF 대표주

S&P 500을 살 거면 → SPY, IVV, VOO

나스닥을 살 거면 → QQQ

미국 기업 전체를 살 거면 → VTI

미국 성장주를 살 거면 → VUG

전세계 기업을 담고 싶으면 → VT

금을 살 거면 → GLD, IAU

은을 살 거면 → SLV

채권을 살 거면 → AGG, LQD

섹터별

반도체 → SMH, SOXX

게임, e스포츠 → ESPO

혁신산업 → ARKK

부동산 리츠 → VNQ

중국 ETF에 관심이 있다면, 아래 글을 보세요.

https://invisiblecity.tistory.com/1485

[미국상장] 중국 ETF 정보(시총, 구성종목, 수수료 등)

중국 ETF 시총순위 MCHI 전세계 상장된 중국 기업 주식을 담았다. 홍콩증시 82%, 중국 16%, 미국 1% 비중. FXI 100% 홍콩증시에 상장된 주식을 담았다. KWEB 인터넷 중국 기업들을 담았다. 홍콩 50%, 중국 42%

invisiblecity.tistory.com

QQQ

Invesco QQQ Trust

미국 나스닥 100을 추종하는 ETF 입니다.

총보수는 0.2%, AUM은 $195B이다. Top 10의 종목 비중은 53.45%

종목 비중

SPYG

QQQ보다는 SPYG를 추천한다. AUM은 $14.7B이며, 보수는 0.04%로 저렴하다. Top 10 종목비중은 50.85%이다. 0.2%도 높은 건 아니지만, 1/5 밖에 되지 않는다. 그러나 SPYG 평균 스프레드가 0.02% 정도로 높기 때문에 이를 감안해야 한다. 1주당 가격이 QQQ 보다 저렴하다.

VUG

VUG는 수수료 0.04%이며, Top 10 종목 비중은 46%이다.

SCHG

Top 10 비중이 53.46%.

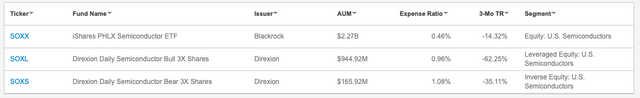

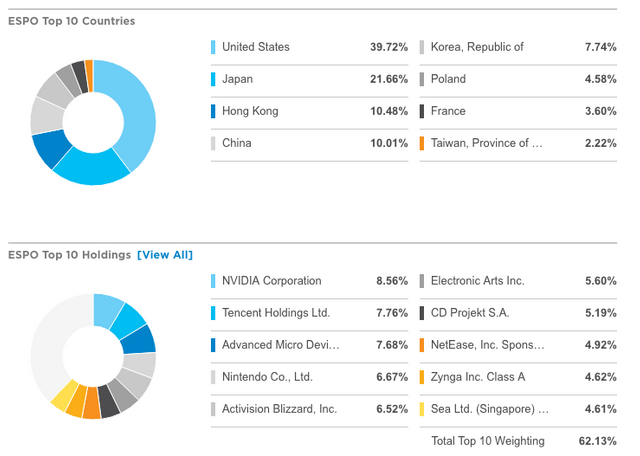

SOXX

iShares PHLX Semiconductor ETF

반도체 섹터에 관심이 있다면 관심을 가질만한 ETF 입니다.

추종지수 : PHLX Semiconductor Sector Index

이 지수를 추종하는 ETF는 몇 가지가 있는데, 다른 종목들은 위험도가 높습니다.

총보수 : 0.46%, 자산규모는 2020년 9월 3일 기준 37억 달러입니다.

차트

국가 비중

Top 10 종목

SMH

SMH는 구성종목이 굉장히 마음에 듭니다. TSMC와 NVIDIA 비중이 25% 가까이 됩니다. 반도체는 이 종목 하나만 꾸준히 매입해도 될 것 같습니다. 수수료는 0.35%로 SOXX 보다 저렴합니다.

AIQ

Global X Future Analytics Tech ETF

글로벌 로보틱스와 인공지능 ETF입니다.

미래에셋이 발행했으며, 총보수는 0.68%. 수수료가 비싼 게 좀 아쉽네요.

차트

국가 비중 & Top 10 종목

미국 채권 ETF

- 미국 종합채 AGG

- 미국 장기국채 TLT

- 미국 하이일드 HYG

- 미국 회사채(BBB) VCIT

- 미국 투기등급 회사채(BB) SPHY

- 미국 투기등급 회사채 JNK

미국 채권 TLT

iShares 20+ Year Treasury Bond ETF (TLT)

20년 이상 장기 국채를 모아 놓은 ETF입니다.

TLT tracks a market-weighted index of debt issued by the US Treasury with remaining maturities of 20 years or more.

총 보수는 0.15%, 배당수익률은 1.64% ~ 2.36% (기관마다 나오는 값이 달라 확인이 필요합니다)

2020년 3월 18일에 투매가 있었으나 회복되었습니다.

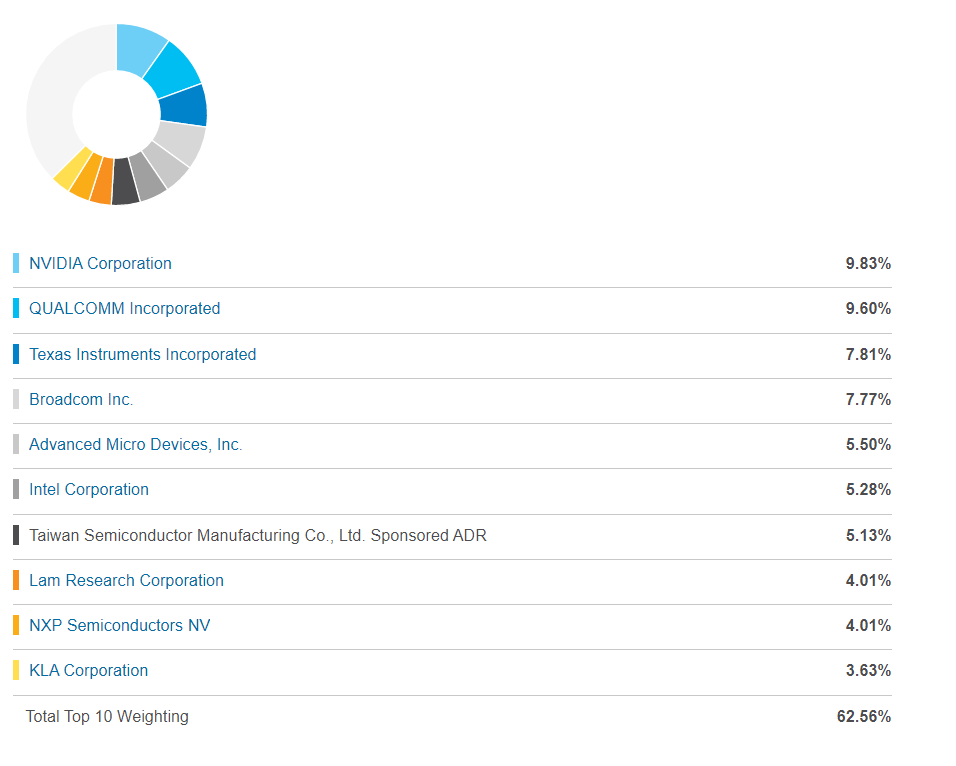

PFF

미국 우선주 ETF 입니다. 안정적이며 5% 중후반대 배당을 주고 있습니다.

분배는 1월이 없고 12월이 2번있습니다.

지난 1년간 PFF의 분배금 내역이다.

출처 : https://www.ishares.com/us/products/239826/ishares-us-preferred-stock-etf#/

HERO

미래에셋이 발행한 ETF로 풀네임은 Global X Video Games & Esports ETF 입니다.

게임과 E스포츠 산업을 담고 있습니다. 코로나 이후 완벽하게 회복했습니다.

국가별로는 미국과 일본, 중국, 한국 비중이 높으며, 종목으로는 NVIDIA와 닌텐도, 블리자드 등을 보유하고 있습니다. (우리나라 넥슨도 보이네요) 게임 산업을 담기에 괜찮은 ETF 같습니다. 총보수는 0.5%

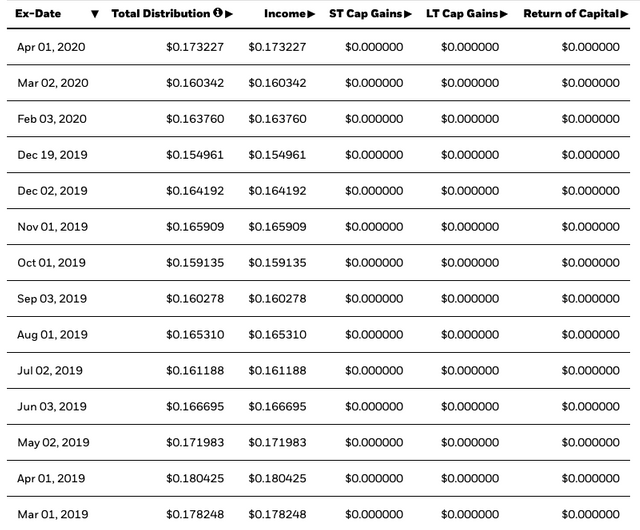

ESPO

VanEck Vectors Video Gaming and eSports ETF

전날 소개한 HERO처럼 비디오 게임과 e스포츠와 관련된 기업들을 담고 있는 ETF이며, 규모는 1억 7천만 달러로 2배 이상 큽니다.

지난 1년간 차트입니다. 회복하여 전고점을 넘어섰습니다.

국가와 종목입니다.

두번째로 비중이 큰 기업 텐센트가 눈에 띕니다.

총보수는 0.55%

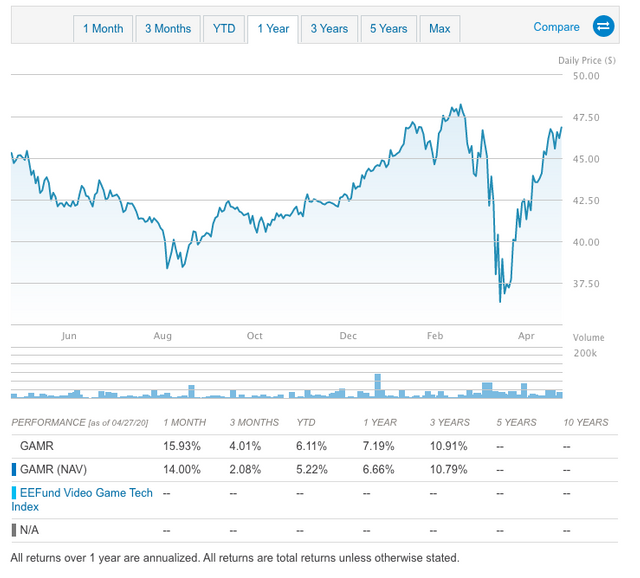

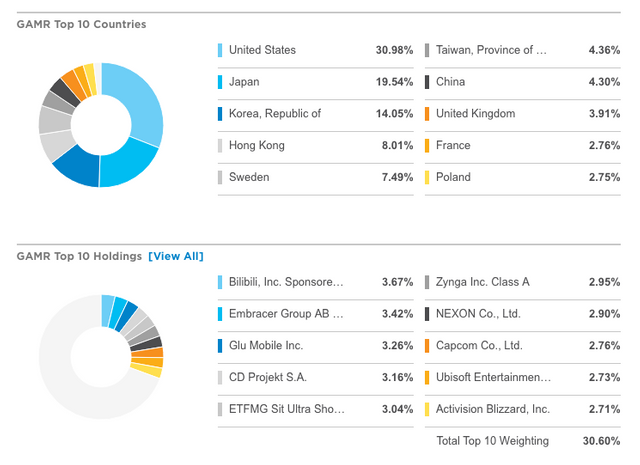

GAMR

지난번에 이어 세번째 소개하는 게임 ETF입니다. 비디오 게임 업체들 위주로 담고 있습니다. 규모는 HERO와 비슷한 7900만 달러.

지난 1년간 차트입니다.

국가별 종목별 비중입니다.

우리나라가 세번째 자리를 차지하고 있네요.

앞서 두 ETF에 담겨 있던 NVIDIA는 없습니다. 비중이 제일 높은 비리비리는 중국 UCC 웹사이트라고 하네요.

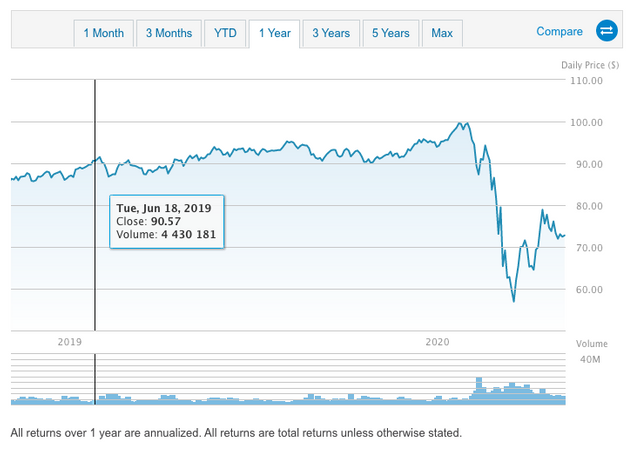

VNQ

Vanguard Real Estate ETF

미국 부동산 리츠 ETF 입니다. 규모는 26억 달러로 부동산 리츠 ETF 가운데 가장 큰 규모입니다. 총보수는 0.12%로 저렴한 편입니다.

지난 1년 주가

이번 코로나 때 손실을 크게 입었습니다.

전부 미국에 상장되어 있는 리츠만 담고 있습니다.

섹터별 종목별 비중입니다.

RSP

Invesco S&P 500 Equal Weight ETF

수수료 : 0.20%

Top 10 종목

국가 : 미국 100%

댓글 영역